Time is Running out for Preparing for Sustainable Farming Funding

With Preparing for Sustainable Farming (PSF) funding likely to end on 31st December 2024, now is the time to take advantage of the funding available for:

- Carbon Audits - £500 of funding.

- Soil Sampling - based on actual costs up to your allowance.

- Animal Health and Welfare Interventions - £250 per intervention, up to a max of two.

- £250 Development Payment for soils and animal health for your first claim.

The Scottish Government opened the Preparing for Sustainable Farming pilot scheme in 2022, with funding available for carbon audits and soil sampling. This was then followed in 2023 with the introduction of options for Animal Health and Welfare Interventions. However, PSF funding will, likely, stop on 31st December 2024. Therefore, it is important that if you want to benefit from it, you act now.

Carbon Audits & Soils

For carbon audit funding, the tool used must be aligned to PAS2050 standard. It must be reviewed by an FBAASS adviser and include recommendations of actions that can be taken to reduce emissions. There is funding of up to £500 available.

For soil sampling funding, you are required to either carry out a carbon audit as above or have had one completed within the last three years to PAS2050 standard. Funding availability is shown below:

- There are two baseline allowances for soil analysis. The baseline allowance amount depends on whether you have more than, or less than, 50 hectares Region 1 land on your Integrated Administration and Control System (IACS) Single Application Form (SAF).

- Greater than 50ha Region 1 land on SAF = 20% of region 1 land x £30.

- Less than 50ha Region 1 land on SAF = Maximum £300 allowance for soil sampling (based on actual costs).

- Funding for taking samples (£4/sample).

- To encourage all applicants to spend time researching best practice for soil sampling and nutrient management (referring to technical notes) - £250.

Examples of the allowances available for soils is shown below:

Animal Health & Welfare

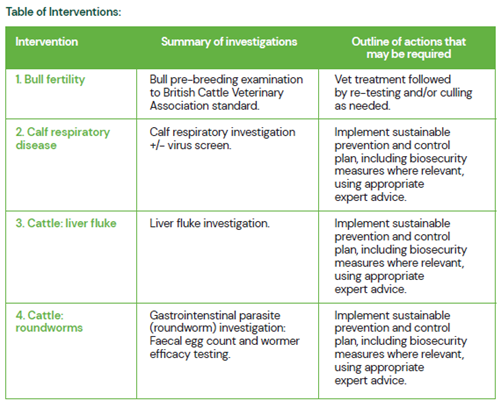

For the animal health and welfare interventions there are a total of nine interventions to choose from, as shown in the table below. Payment will be made on evidence of investigation plus advised action.

- The action must be defined by an expert advisor, e.g., your local vet.

- Undertaking investigation alone will not be eligible for payment. For example, undertaking a faecal egg count test for liver fluke would not be eligible unless you took expert advice such as a control plan.

- To claim, this supporting document of advised action would need to be signed by advisor (vet or consultant) as well as proof of investigation. The works for your 2024 claim would need to be completed between 1 January 2024 and 31 December 2024 and claimed by 28 February 2025.

A standard cost of £250 will be paid for each intervention (up to £500 per business). A one-off payment of £250 for education and research of animal health and welfare is available to crofters and farmers on their first claim.

5 Top Tips

- There is no application process – just a claims process.

- Act now to benefit from PSF funding for carbon audit/soil and/or animal interventions.

- Ensure options have been completed and invoiced if applicable by 31st December 2024.

- Ensure you have supporting documentation signed off by an expert advisor.

- Ensure 2024 claims are submitted by 28th February 2025.

Willie Budge, Senior Consultant and Area Manager, Willie.Budge@sac.co.uk

Unearthed is the exclusive SAC Consulting members' monthly newsletter. Unearthed offers insights and tips from our experts on what we think is in store for farming and crofting in the coming months in order to protect and enhance your business.

Posted by Unearthed News on 18/11/2024