Response to the 2024 Autumn Budget

The budget outlined by the Labour Chancellor, Rachel Reeves, on 30 October is one of the largest fiscal shifts seen in recent decades. The tax rises seen are the second largest in the post-war period.

The starting point to note is that the budget was an almost impossible job. In general, people want more investment in public services and improvement in economic growth – achieving this without raising taxes is impossible as both require funding. Whether the balance has been achieved or not, what has been outlined is very different to what was pitched during the election campaign.

Approximately half of spending will be funded by tax raised, with the remainder borrowed (additional £40bn tax revenues, additional £76bn spending). Despite some large changes in fiscal policy and investment increases, financial markets are sceptical but have not been spooked as plans have shown how public finances will be stabilised.

The scale of tax changes clearly hurts growth. The Office for Budget Responsibility (OBR) forecast expects faster growth rate in short term, but the 5-year forecast shows little to no benefit. Labour are relying on the even longer term forecasted impact of their capital spending plans (10 years +).

Summary of Key Changes that Affect Agricultural Businesses

Employment Taxes

The budget contains a number of changes that impact businesses with employees – an increase in employers National Insurance contributions (NIC), a rise in minimum wage and a focus on employee rights. While some measures are helpful for individuals, the final result is that the cost of employing staff has increased across the board.

National Insurance Contributions (from April 2025)

- Employers' NIC rate will rise by 1.2% to 15%.

- Reduction in the secondary threshold, above which employers' NIC is payable, will drop from £9,100 to £5,000 per annum.

- This means an additional £4,100 per employee potentially subject to charge at 15% (£615 per year).

National Living Wage/National Minimum Wage (from April 2026)

- Increase in minimum wage and first step towards a single adult rate (rather than 18-20 and over 21)

Both changes result in significantly more cost for employers. For an employee on an average salary (£36k) this results in an annual cost increase of ~2% at £930 due to changes in NIC. For a full-time employee on the National Living Wage (at 35hr week) this results in a cost increase of ~10% at £2,300 due to a combination of gross pay increases and NIC. For part time workers this rises further.

When extrapolated across an entire business, this becomes expensive. This will particularly impact industries with lots of employees that are lower paid/close to the National Living Wage such as poultry or fruit/veg businesses.

Employment allowance (from April 2025)

- Increase from £5,000 to £10,500.

- Also removed the upper threshold so now available to all employers.

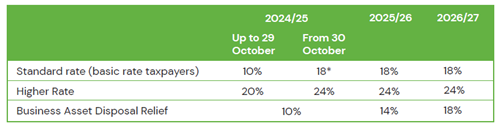

Capital Gains Tax

- Increase in both the standard and higher rates of Capital Gains Tax (CGT) have been confirmed with immediate effect.

- Business Asset Disposal Relief (formerly Entrepreneurs Relief) will be retained with the same lifetime limit of £1m, however the tax rates will increase over coming years

- The increased Business Asset Disposal Relief (BADR) rate still maintains a gap to headline rates, but the reality is a difference of up to £80,000 in tax bills.

Inheritance Tax

The key headline for agriculture is around changes to APR/BPR. In addition, it was announced that the nil rate band will remain at the same £325k level until 2030 (for an additional 2 years).

Agricultural Property Relief/Business Property Relief (From April 2026)

- Cap imposed on relief available under APR and BPR

- First £1m of combined business and agricultural assets remain exempt

- For assets over £1m – IHT will be applied at 50% of the full rate (i.e. 20% effective rate)

- It is important to note that this is on top of the nil rate band and principle private residence reliefs. For a married couple this could result in an additional £1m of assets passed on tax free. If the farm is a partnership and in joint ownership, the £1m APR/BRP is also available to each partner.

- For a husband and wife in partnership, this could potentially result in passing on £3m of assets tax free

- Anti-forestalling rules came into force with immediate effect to stop avoidance. If considering gifting your assets before death, speak to your accountant to ensure this is structured appropriately.

- Technical consultation will take place in early 2025, however this will be on the administrative/reporting requirement – unlikely to relate to changes in the reliefs/exemptions themselves

The impact of these changes will vary depending on your specific situation. Overall these changes may spark the need for conversations about succession and efficient structuring of assets for tax purposes. Please seek professional advice from your tax accountant/financial adviser to navigate this change.

Double Cab Pickups (from April 2025)

A quiet addition to the budget which will impact farming clients. The change follows on from a recent Court of Appeal judgement. This is effectively the same change that HMRC announced in February 2024 and reversed a week later.

- Double cab pickups (with a payload of 1 tonne or more) will be treated as cars for certain tax purposes.

- Covers Corporation Tax and Income Tax.

- Also impacts Capital Allowances.

- Pickups currently qualify for the 100% AIA, whereas now will be limited to the 18% allowance seen by cars.

- Will significantly impact Business In Kind (BIK) rates on company cars.

- For a basic rate taxpayer, would rise from about £66p/m to £300p/m.

- Existing BIK treatment will apply to assets purchased/ordered before change date and will last until disposal or 2029 – a key difference to the February announcement.

- No change to VAT treatment.

Other Notable Points

- Fuel duty frozen and the 5p cut maintained for another year.

- From April 2028, Income Tax and NIC thresholds will unfreeze and start to rise in line with inflation (however Income Tax is devolved to Scotland so need to await Scottish Government response).

- Budget solidifies the idea that the ultra-low-interest rate era is behind us. Inflation forecasts remain steady around 2% until at least 2028, with the Bank of England base rate forecast now falling slowly to a rate of 3% by the end of 2026 and staying there.

- Making Tax Digital (MTD) for Income Tax to come into effect from April 2026 for those with a trading and property income of over £50k as planned. Those with income over £30k to join a year later and plans now announced for those with income over £20k to join during this parliamentary term (presumably after April 2027).

Andrew Coalter, Senior Consultant and Area Manager, Andrew.Coalter@sac.co.uk

Unearthed is the exclusive SAC Consulting members' monthly newsletter. Unearthed offers insights and tips from our experts on what we think is in store for farming and crofting in the coming months in order to protect and enhance your business.

Posted by Unearthed News on 18/11/2024